Ultra-wealthy Americans—those with a net worth of at least $25 million—are increasingly seeing new faces among their ranks. But they’re often not the usual suspects—members of the Baby Boomer generation or older.

Instead, we’re seeing a surprising number of the ultra-wealthy among Millennials—those 72 million Americans born between 1981 and 1996.

Millennials make up much of the ultra-wealthy market. It’s generally assumed that the wealthiest people are the oldest people—which, given how assets can potentially grow over time, makes sense. But when CEG Insights surveyed 165 members of the ultra-wealthy, one surprising finding was that a sizable percentage—43.0%—were Millennials. That compares to 23% who were Gen Xers and 29% who were Baby Boomers.

Millennials really value wealth. More than any other generational group, Millennials believe that happiness stems in large part from the amount of wealth they accumulate (89.5% versus 78.6% overall).

Millennials don’t value spending over all else. An enormous percentage of ultra-wealthy Millennials (87.5%) say that saving and investing give them greater satisfaction than spending.

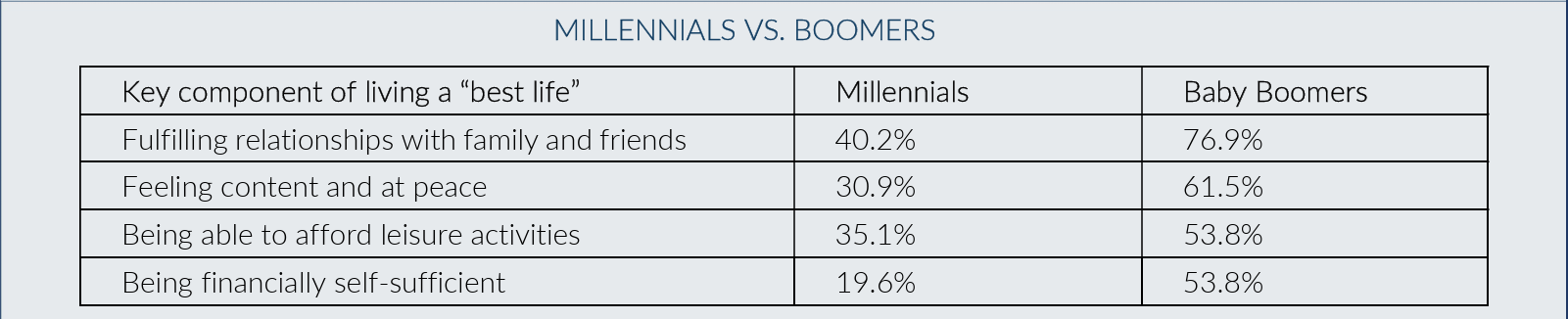

Millennials have strong views on what “living their best life” means. The majority of Millennials say that living their best life means a life that aligns with their values. The other most common responses (cited by at least 40% of Millennials) were “maintaining good health,” “pursuing passions” and “having fulfilling relationships with family and friends.”

Millennials were much more likely than Gen Xers and Boomers to say that a healthy work-life balance is important to living one’s best life. And yet, they’re also much more likely to list “professional achievements” as a key part of a great existence.

Millennials share many financial concerns. Financially, Millennials’ concerns echo those of most other generational groups in several ways. For example, issues involving inflation, tax increases and stock market performance were all big concerns for Millennials as well as both younger and older investors. That said, Millennials were significantly more likely than the ultra-affluent overall to cite “maintaining their current financial position” as a key concern (90.4% versus 77.8%). Given the value they place on wealth accumulation, they’re likely acutely worried about not reversing course with their financial status.

1 CEG Insights, The $25 Million-Plus Opportunity, 2023

MILLENNIAL TRAITS

Millennials are family-focused. It’s important to emphasize that Millennials don’t appear to be seeking to build significant wealth for only themselves and their own desires. Consider that the vast majority of Millennials share a number of family-oriented financial concerns—such as having enough money to leave to posterity, paying for heirs’ education needs and leaving a legacy for their heirs. Indeed, just 3.1% say they don’t want to leave a legacy. Millennials define what it means to leave a legacy to their heirs in a few key ways—including:

- Passing down significant financial assets (59.8%)

- Passing down their way of life (53.6%)

- Passing down morals and values (44.3%)

There are some striking differences between Millennials and members of the Baby Boomer generation in terms of values. When asked about specific components that make up someone’s “best life,” we saw some sizable gaps (see the chart below).

A few key differences between Millennials and Gen Xers also stood out. For example, Gen Xers were even more likely to say that living your best life means “a life that aligns with your own values” (74.4% versus 58.8% of Millennials). But Gen Xers appear to care much less about professional success: Just 7.7% of Gen Xers say that’s part of the definition of living your best life—versus 22.7% of Millennials.

Recognizing these types of differences may be helpful when it comes to family members of different generations doing a better job of understanding each other’s feelings and priorities. Likewise, multigenerational work environments could potentially be improved by having the various cohorts “get” each other on a deeper level.

Millennials seek to give back. We also see that ultra-wealthy Millennials are often actively engaged in charitable giving, with $10,001 to $25,000 being the most common amount of money this group donates to charities in a typical year (21.6%). What’s more, a full (15.5%) of ultra-wealthy Millennials give more than $250,000 in a typical year. The bulk of those contributions are going to three main areas: religious organizations (18.4%), colleges/schools (15.2%) and environmental causes (12.4%).

Ultimately, Millennials don’t all fit neatly into the stereotypes many people have of this generation.

Fidato Wealth LLC is a Registered Investment Adviser. Please note that the use of the term “SEC Registered Investment Adviser” and description of Fidato Wealth LLC and/or our associates as “registered” does not imply a certain level of skill or training. This brochure is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Fidato Wealth LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Fidato Wealth LLC unless a client service agreement is in place. If you are not the intended recipient, or the employee or agent responsible for delivering the message to the intended recipient, you are notified that any review, copying, distribution or use of this transmission is strictly prohibited. If you have received this transmission in error, please (i) notify the sender immediately by e-mail or by telephone and (ii) destroy all copies of this message. Please note that trading instructions through email, fax or voicemail will not be taken, as your identity and timely retrieval of instructions cannot be guaranteed. If you do not wish to receive marketing emails from this sender, please send an email to sayhello@fidatowealth.com. This article was published by the VFO Inner Circle, a global financial concierge group working with affluent individuals and families and is distributed with its permission. Copyright 2025 by AES Nation, LLC. Fidato Wealth is not affiliated with AES Nation, LLC. AES Nation, LLC is the creator and publisher of the VFO Inner Circle Flash Report.

DOWNLOAD A PDF VERSION OF THIS ARTICLE HERE