Comprehensive Retirement Planning

Comprehensive

Retirement Planning

For individuals approaching retirement, we believe comprehensive planning is crucial to ensuring a smooth transition and a financially secure retirement phase. The following are the key types of planning that should be considered:

- Retirement Income Planning: Establishing a strategy to generate a steady income stream from various sources such as pensions, retirement accounts (401(k), IRAs), social security benefits, and other investments.

- Investment Management: Adjusting investment strategies to balance growth and income generation with risk management, focusing on preserving capital and maintaining a portfolio that can sustain inflation, taxes, and withdrawals over the retirement period.

- Healthcare Planning: Planning for healthcare costs, including Medicare enrollment, supplemental insurance, and long-term care insurance, taking into account the potential for rising healthcare expenses in retirement.

- Tax Planning: Understanding the tax implications of retirement withdrawals and strategizing to minimize tax liabilities, including the timing of withdrawals from tax-deferred accounts.

- Estate Planning: Ensuring estate plans are updated, including wills, trusts, powers of attorney, and beneficiary designations to reflect current wishes and family circumstances.

- Social Security Optimization: Deciding the optimal time to start taking Social Security benefits to maximize lifetime benefits, considering factors like health, life expectancy, and spousal benefits.

- Budgeting and Expense Management: Creating a retirement budget that accounts for regular expenses, discretionary spending, and potential unexpected costs, ensuring that retirement income covers these needs.

- Lifestyle Planning: Considering lifestyle choices such as relocation, travel, hobbies, or part-time work, and how they impact financial planning.

- Philanthropic Planning: If desired, planning for charitable giving during retirement, which can also provide tax benefits.

Each of these elements should be carefully integrated into a cohesive retirement plan, tailored to the individual’s goals, needs, and financial situation.

Regular reviews and adjustments are essential to adapt to changing circumstances and ensure ongoing financial security.

Our Wealth Management

Consultative Process

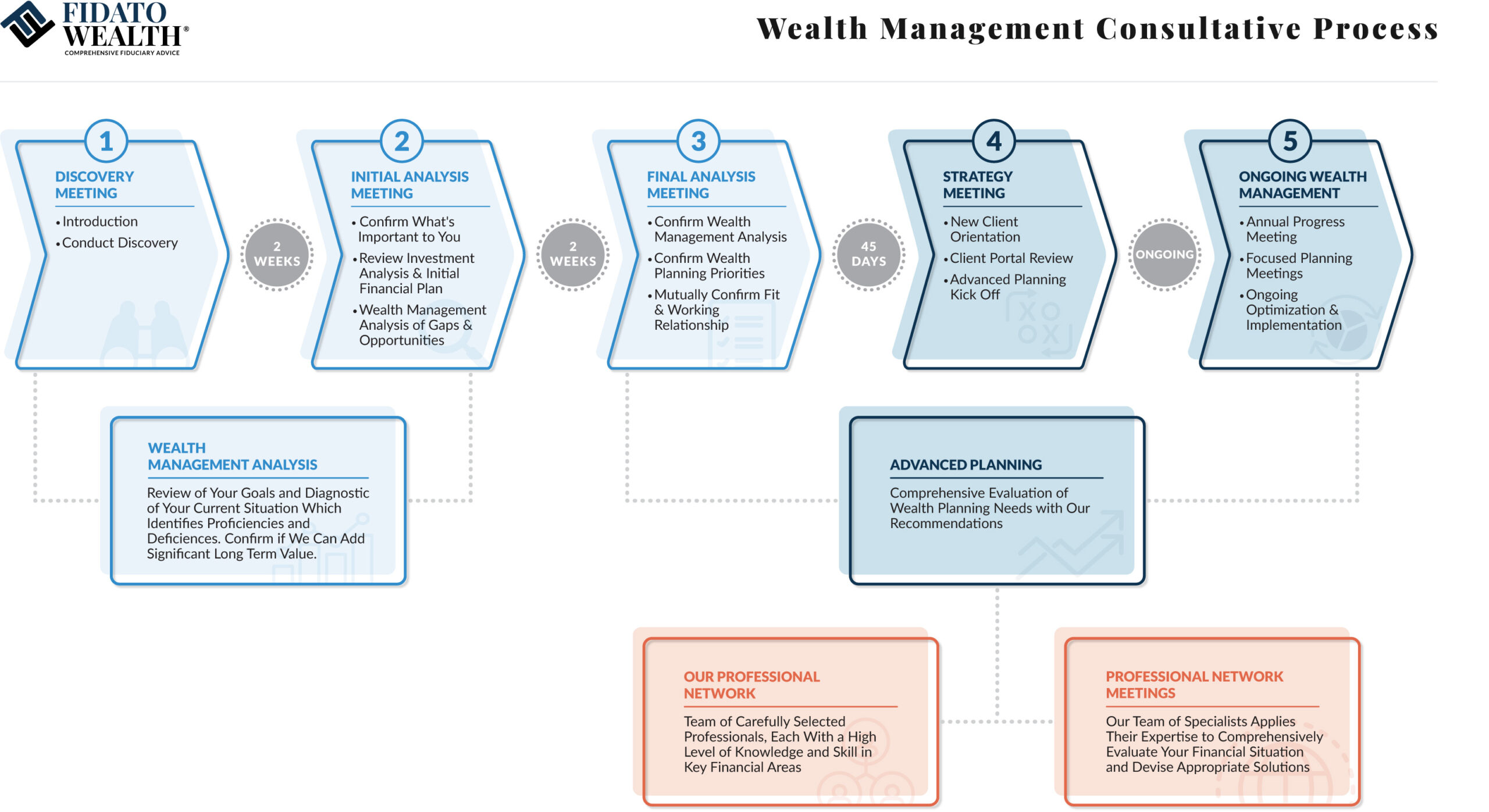

Our Retirement Wealth Planning Process is designed to meet your goals and vision for your life. In the associated graphic, you can see the steps we take as we evaluate your entire financial situation and build a comprehensive plan for both your present and your future.

Our team of advisors create custom, thorough plans that encompass the details needed to help ensure you have a comprehensive and holistic retirement plan. We look forward to partnering with you to help achieve your vision.

Our Experience

When it comes to your retirement, you need a guide that keeps your best interest first and foremost.

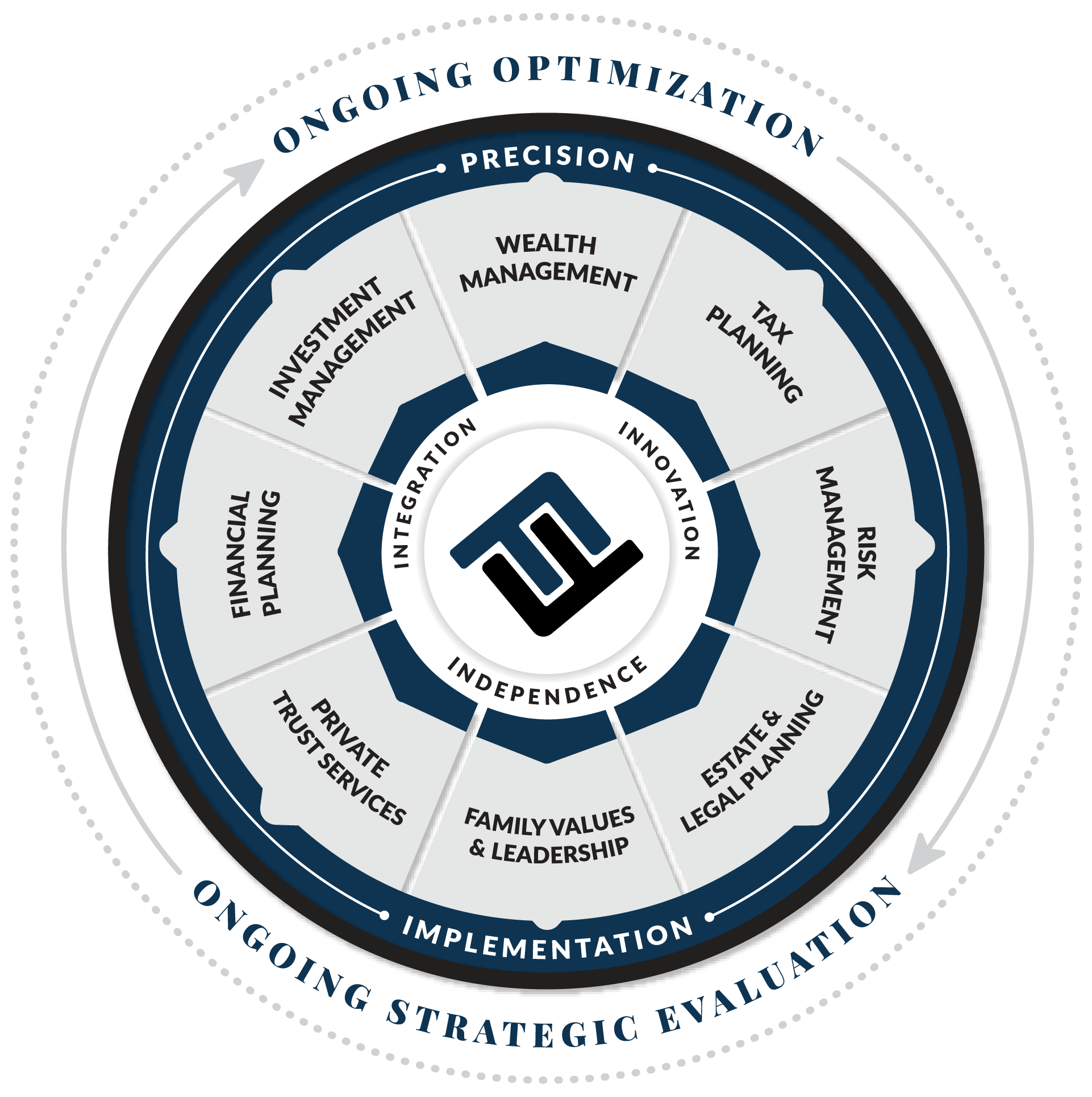

We specialize in comprehensive wealth management and financial planning that does just that. We’ll analyze your whole financial picture, develop a comprehensive financial plan, and make sure you understand all of your options.

We have experience working with clients who are executives or key management at corporate, healthcare and government employers including NASA, University Hospitals, Swagelok, Ford Motor Company, The Cleveland Clinic, among many others.