Wealth Planning for Executives

Wealth Planning

for Executives

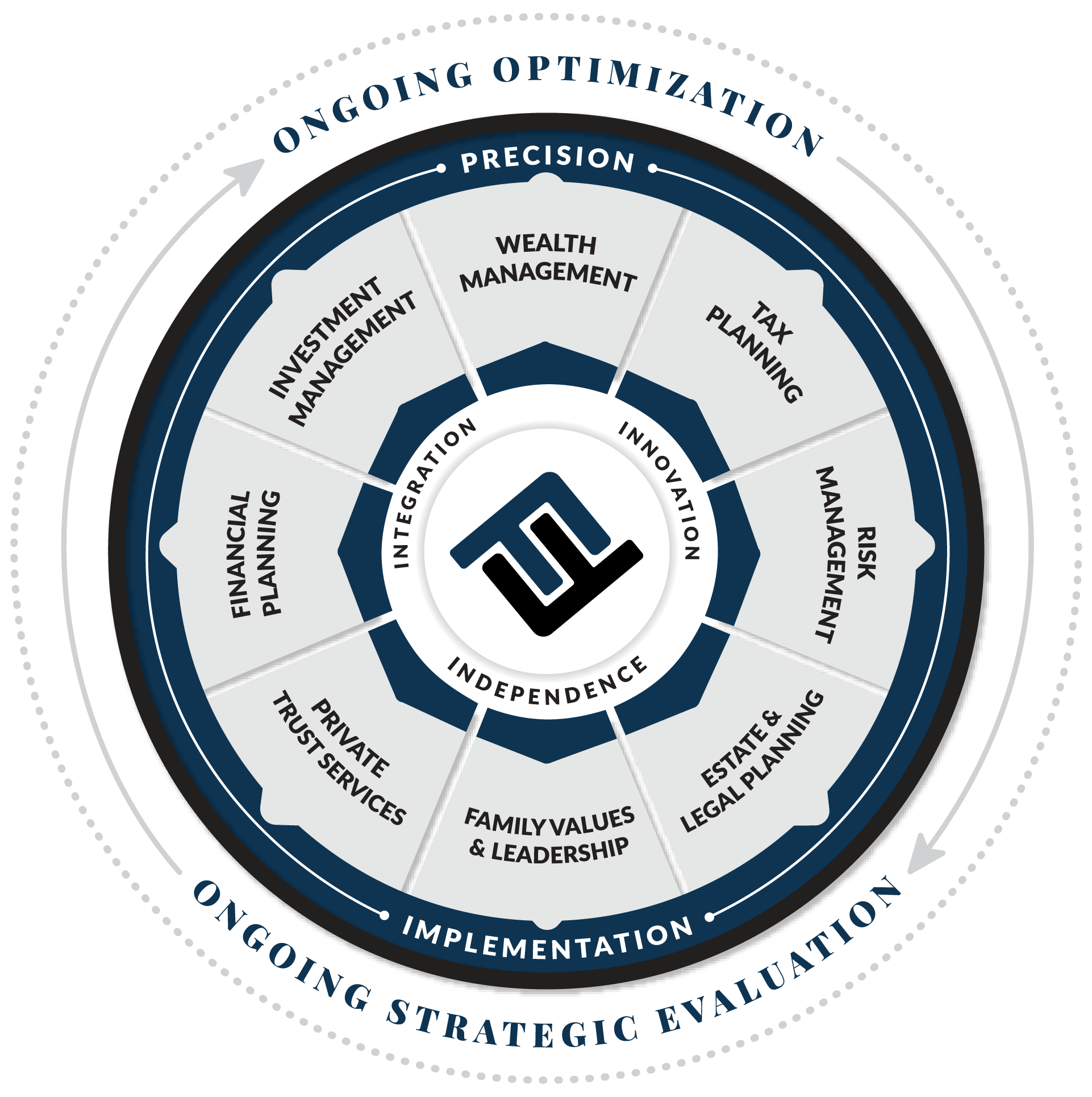

Executives, particularly those with significant investable assets, require comprehensive financial planning that covers several key areas:

Executive Compensation Planning: Executives often have complex compensation packages, including salary, bonuses, stock options, and restricted stock units. We can help executives understand their compensation options and structure them with the goal of maximizing wealth and minimizing taxes.

Tax Planning: Strategies to minimize tax liabilities, leveraging tax-advantaged investments, and understanding the impact of various financial decisions on your tax situation. Just about every financial plan decision has tax implications. Our goal is to minimize your lifetime tax bill through ongoing strategic tax planning.

Investment Management: Tailored strategies to manage and grow your investment portfolio, considering your risk tolerance, time horizon, and financial goals.

Retirement Planning: Long-term planning to ensure a secure and comfortable retirement, including pension management and retirement income strategies.

Estate Planning: Ensuring the efficient transfer of wealth to beneficiaries in order to empower them and promote family harmony, as well as setting up trusts or other legal structures as needed.

Risk Management: Assessing and managing risks associated with your personal and professional financial landscape, including insurance planning.

Succession Planning: For executives who are also business owners, planning for the transfer of your business interests and leadership roles.

Liquidity Event Planning: Guidance on managing financial affairs before and after significant liquidity events, such as selling a business or receiving a large inheritance.

Education Planning: If applicable, strategies for funding your children’s or grandchildren’s education.

It’s important to tailor these planning elements to the unique needs of each executive, considering personal, family, and professional circumstances. Regular review and adjustment of these plans are crucial as life stages and financial situations evolve.

Our Wealth Management

Consultative Process

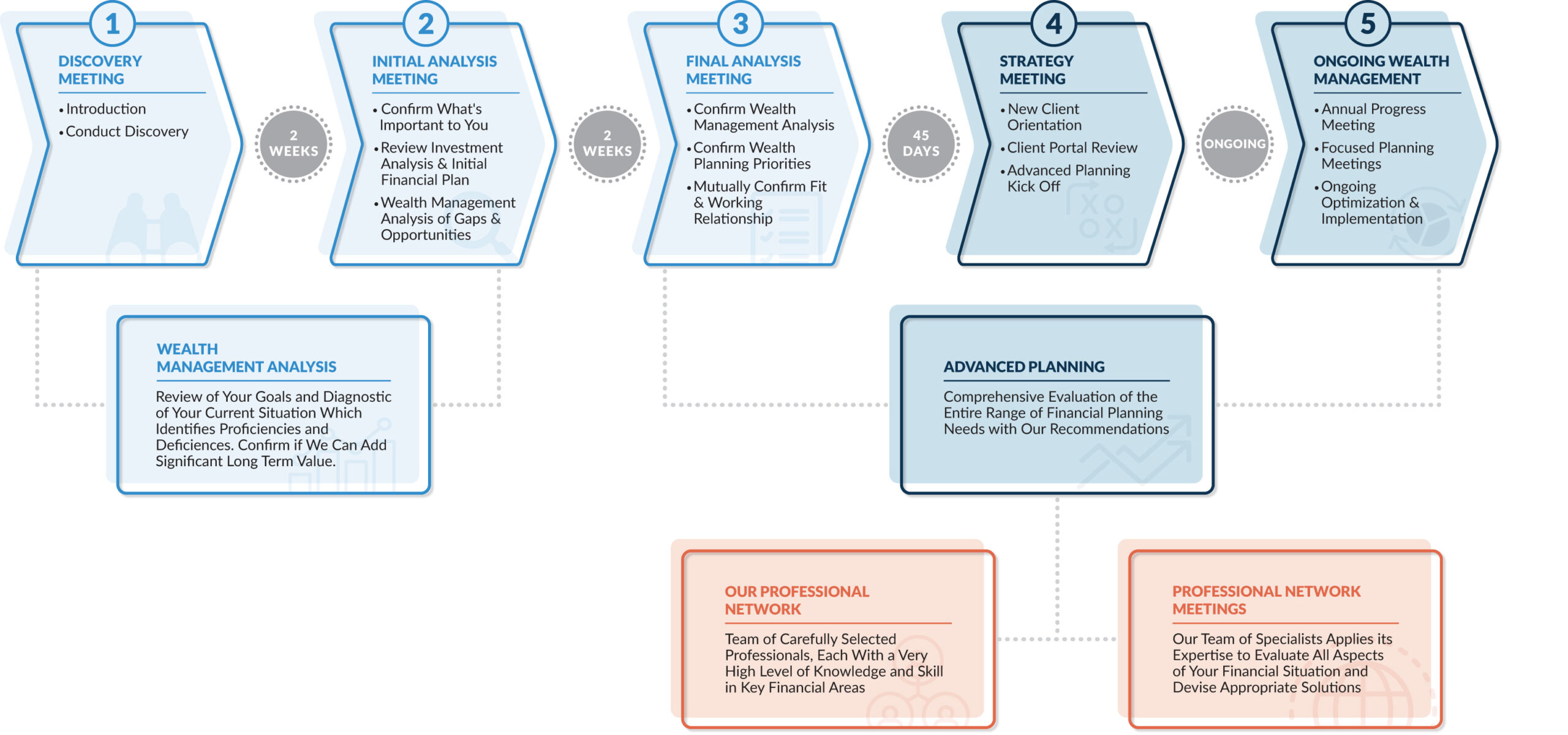

Our Wealth Planning Process for Executives is designed to meet your goals and vision for your life. In the associated graphic, you can see the steps we take as we evaluate your entire financial situation and build a comprehensive plan for both your present and your future.

Our team of advisors create custom, thorough plans that encompass the details needed to help ensure you have a comprehensive and holistic retirement plan. We look forward to partnering with you to help achieve your vision.

Our Experience

When it comes to executive benefits, you need a guide that keeps your best interest first and foremost.

We specialize in comprehensive wealth management and financial planning that does just that. We’ll analyze your whole financial picture, develop a comprehensive financial plan, and make sure you understand all of your options.

We have experience with clients who are executives or key management at corporate, healthcare and government employers including NASA, University Hospitals, Swagelok, Ford Motor Company, The Cleveland Clinic, among many others.