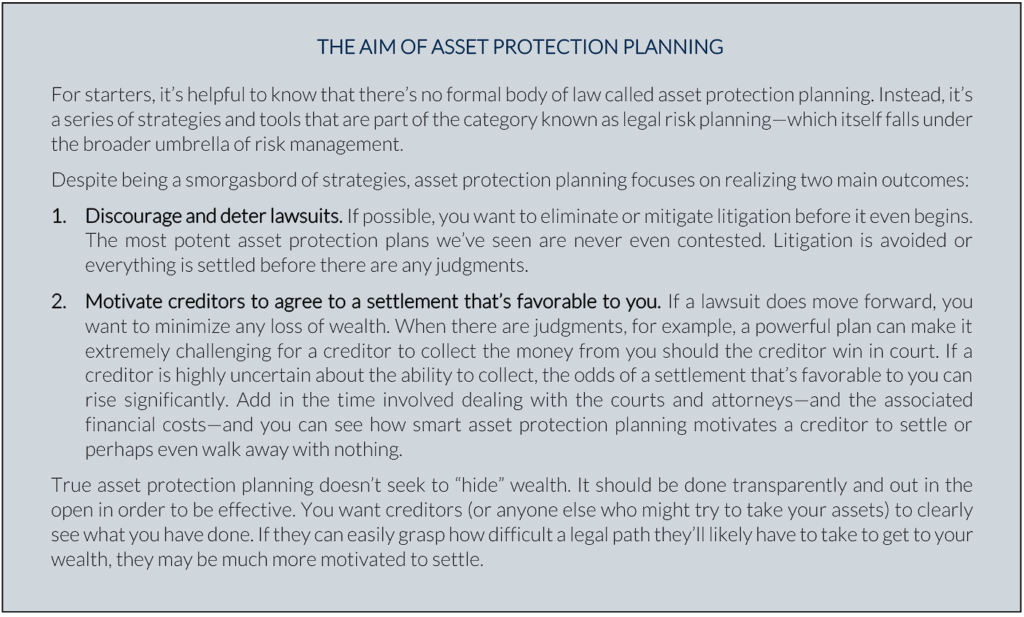

If you’re a high-income professional or entrepreneur—or if you simply have a substantial net worth—you probably realize that in today’s litigious culture, you could be an attractive target for unfounded or frivolous lawsuits.

But what have you done to actually reduce the risk of losing your wealth if you get sued? In our experience, far too many affluent individuals and families don’t act to protect their assets, livelihoods and lifestyles.

The good news: There are many strategies that can help safeguard your wealth against those who would unjustly seek to take it. Here’s a look at the world of asset protection planning and how you might be able to harness it for your advantage.

KEY ASSET PROTECTION PLANNING FACTORS

Some important aspects of asset protection planning to keep in mind as you explore your options include:

▪ Be flexible. Your asset protection plan should be modifiable, to the extent possible, so you can adapt it as laws and circumstances change.

▪ Use multiple asset protection strategies. Redundancies tend to increase your ability to effectively insulate your wealth. What’s more, you can tackle asset protection in multiple ways. For example, some estate planning strategies—the primary goal of which is to transfer wealth to heirs—also provide creditor protections. Therefore, implementing an estate plan can potentially be one way to strengthen asset protection efforts.

▪ Be cost-effective. Asset protection solutions’ upfront costs include initial planning and implementation. Some strategies have ongoing costs as well. Get a good handle on the full range of costs before you move forward in order to determine whether the benefits justify the expenses.

▪ Implement these strategies before you need them—or even think you may need them. Put a plan in place after trouble arises (or even shortly before a lawsuit that seems imminent) with the intent of dodging creditors, and you might find your strategy negated by a judge. Worse, you potentially could be charged with contempt, fraud or civil conspiracy for engaging in “fraudulent conveyance.”

REGULAR REVIEWS

Like any fundamental component of a wealth management plan, an asset protection plan is not a “set it once and forget it” type of solution. If you have a plan in place, you need to revisit it regularly to determine whether it’s still correctly positioned to pursue the outcomes you seek.

The reason: Asset protection planning is regularly in a state of flux. Changes in laws and regulations can make existing strategies less (or more) effective, while also setting the stage for novel approaches. Meanwhile, asset protection planning experts are constantly seeking ways to shield the wealth of the affluent—while creditors and their professionals are always looking for ways to collect.

Clearly, you can’t create an asset protection plan and then let it sit in a drawer or on a hard drive for the rest of your life! Commit to revisiting your plan whenever major circumstances change—such as when new tax laws are introduced or your own personal or professional wealth situation changes. If you haven’t revisited your plan for more than five years, chances are it’s time to do so.

STRESS TESTING

If you’re wondering whether your asset protection plan is still structured to pursue your specific goals, consider stress testing it by asking your advisor to review how it is likely to behave in various scenarios you might face. A stress test is a formal process that assesses the probability of an existing plan, strategy or product delivering the results you think it will and want it to. Stress testing can also be an excellent way to put a plan, strategy or product that you’re considering implementing “through its paces.”

Ultimately, a stress test can help you determine that the asset protection you have in place is just what you need. Conversely, it might reveal that you could benefit by making adjustments to your existing setup. In either case, you’ll know what’s needed to help you shield your wealth.

Fidato Wealth LLC is a Registered Investment Adviser. Please note that the use of the term “SEC Registered Investment Adviser” and description of Fidato Wealth LLC and/or our associates as “registered” does not imply a certain level of skill or training. This brochure is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Fidato Wealth LLC and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Fidato Wealth LLC unless a client service agreement is in place. If you are not the intended recipient, or the employee or agent responsible for delivering the message to the intended recipient, you are notified that any review, copying, distribution or use of this transmission is strictly prohibited. If you have received this transmission in error, please (i) notify the sender immediately by e-mail or by telephone and (ii) destroy all copies of this message. Please note that trading instructions through email, fax or voicemail will not be taken, as your identity and timely retrieval of instructions cannot be guaranteed. If you do not wish to receive marketing emails from this sender, please send an email to sayhello@fidatowealth.com. Copyright 2023

DOWNLOAD A PDF VERSION OF THIS ARTICLE HERE